A Solar Stock to Benefit from... Artificial Intelligence (free / 3 minutes read)

First Solar is making a lot of money on data centers!

Opportunity 𝐨𝐟 𝐭𝐡𝐞 𝐖𝐞𝐞𝐤: 𝐚 𝐒𝐨𝐥𝐚𝐫 𝐄𝐧𝐞𝐫𝐠𝐲 𝐒𝐭𝐨𝐜𝐤 Trading at a Discount

First Solar Inc. (FSLR) is a U.S. solar technology company that provides photovoltaic (PV) solar energy solutions in the United States primarily. It is a business that has the attention of the federal government due to its critical role in the energy agenda of the country. The government has been protected and will continue to protect the company against the cheaper Chinese manufacturers.

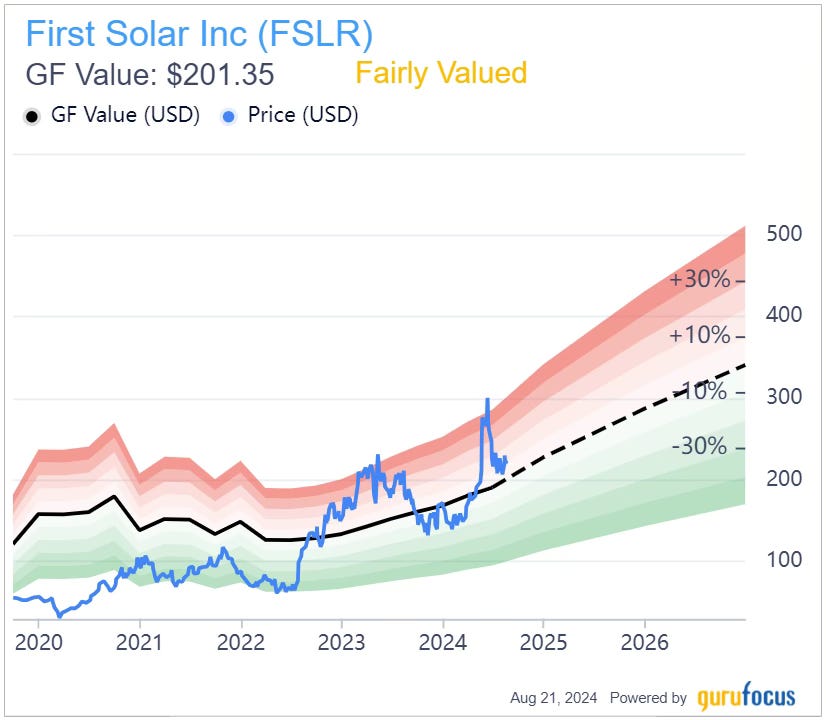

First Solar is trading at fair value, having dropped some 20% from its recent highs. It's trading at $227 after briefly reaching the symbolic $300.

The stock is trading at 20 times earnings, below the pre-Covid levels of 25 to 30. I like to look at pre-covid, as many valuations ballooned during the pandemic and favorable monetary policy. First Solar is cheaper now despite improved growth prospects.

Generational Tailwinds

A few things that keep me excisted as a shareholder:

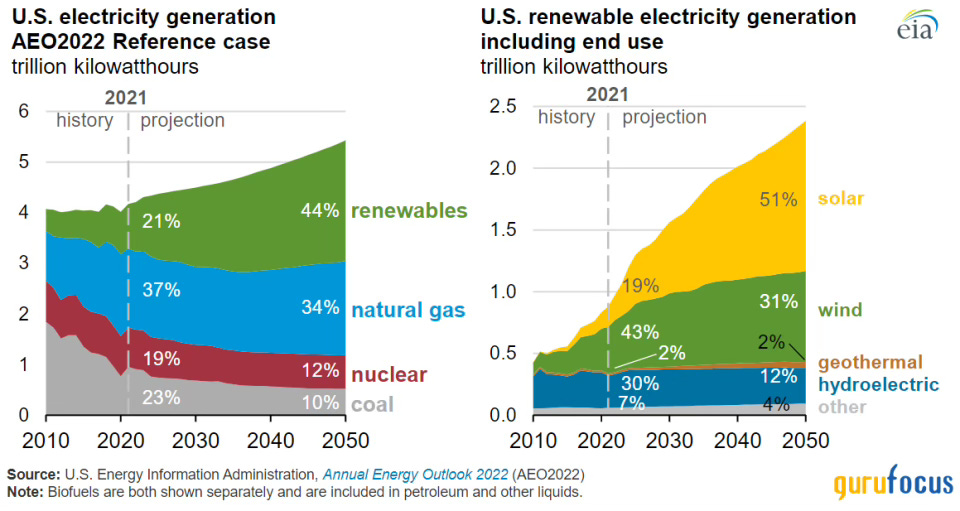

Wind and solar combined also surpassed coal generation during the first four months of 2024.

Q2 showed a doubling of quarterly profits, driven by a demand surge in artificial intelligence. The energy demand of data centers has increased almost exponentially over the last several years.

Sufficient demand pipeline already until 2030!

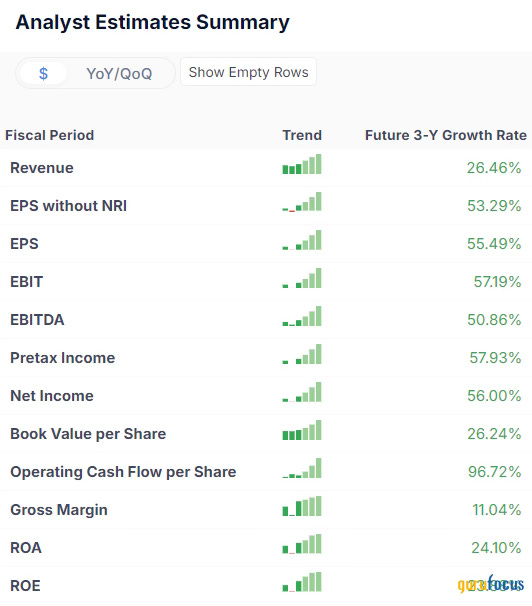

All these tailwinds should continue supporting the impressive growth rates from top to bottom line and across the balance sheet. It’s a wonderful stock to own within a diversified portfolio, or within an AI + Energy mix.

𝐔𝐒 𝐄𝐥𝐞𝐜𝐭𝐢𝐨𝐧 𝐅𝐞𝐚𝐫𝐬

Fears of a Trump-Vance victory (pro fossil fuels) are irrational and the company together with the solar sector actually performed very good during both Trump's and Biden's presidential terms. There is a real long-term growth trajectory based on solar energy demand in the US, especially given the incredible sun exposure in the American Southwest. These fears give a great entry point before it flies up.

The increasing share of renewables and in particular of solar energy within the U.S. energy production (thanks to an extremely sunny South of the U.S. with large financial means) will likely act as a tailwind for First Solar, regardless of internal politics.

For all these reasons, in my opinion it's a potential multibagger stock, with a steady growth and likely to double in price in the next 3 to 5 years.

Thank you for your support and don’t hesitate to turn on the paid subscription to support my independent work.

That would mean the world to me. 💚🙏

Akim

Great business but an uncertain industry.

There's institutional accumulation across the entire Solar Industry. It's poised for growth.