4 minutes that save you days of research and might bring you years of solid stock performance.

Timothy presented in great fashion ASML’s business and its moat. His part is available on Panic Drop, his newsletter through this link: Part I .

Panic Drop explained it well: ASML’s moat is its unique capability in EUV lithography, supplying the indispensable tools for cutting-edge semiconductor manufacturing, which directly impacts AI chip production. Companies like Nvidia are heavily dependent on ASML.

And as Timothy mentioned, and I actually like that sentence very much: “a great business can be a lousy investment if you pay too much for it.” This would probably have become a famous quote if it came from Warren Buffett or Charlie Munger.

So let’s look at the hard figures now and see why today’s stock price is a pretty good entry price.

Financials

Starting with the financials, one thing pops to the eye almost immediately: ASML’s growth rates in the last decade has been absolutely impressive. The company’s revenue grew by an average of 18.42% per annum, with seven years of double digit growth and three years of upper single digit growth.

2024 is expected to be the worst year for the business since 2012 with no growth (+0.4% on the year) and a slight decline in net income. This is due to several headwinds. The CFO Roger Dassen described the customers as "being very cautious with cash, being very cautious with capex, and as a result of that, they're also very cautious with putting in orders".

The company reassured that 2024 is a “transition year” and the growth slowdown is only temporary, because of supply chain disruptions, tight monetary policies across the global, inflationary pressures on labor costs and the resulting economic uncertainty.

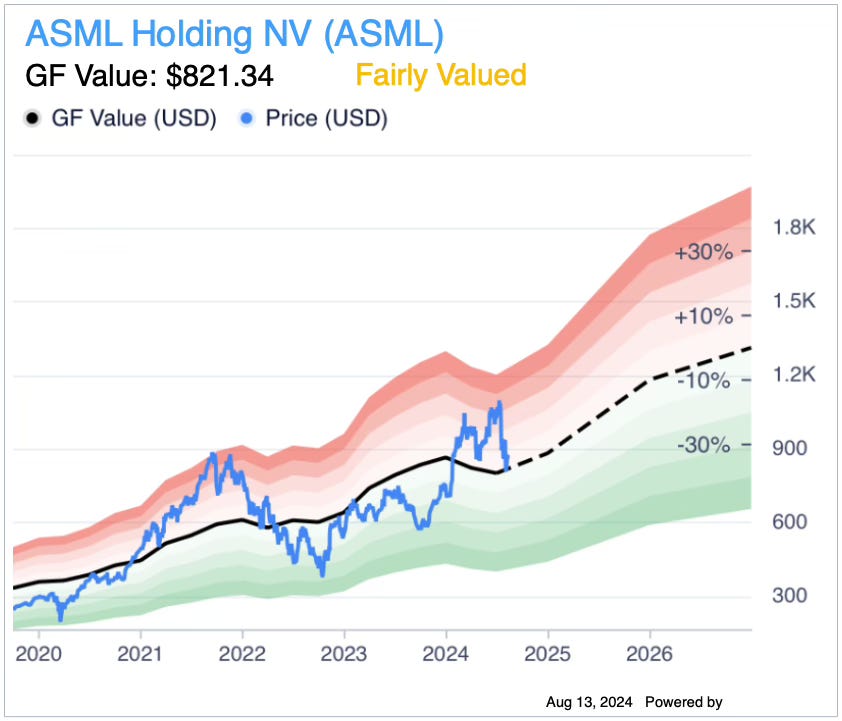

This explains the 25% drop in stock price we witnessed within just a few weeks, and that completely discounts the lack of growth this year and puts it back to its fair value, as shown in the below GuruFocus chart. To put it in perspective, the stock is still up 190% over the last five years and an impressive 755% over the last ten years. It’s now trading at both a fair value support and at a 50-day moving average confluence.

There is no change in the fundamentals however, and that is what matters to an investor. And investors are forward looking: what matters is the next couple of years. Good news on that front: ASML is expected to grow by over 30% in 2025 and remain on double digit growth for at least three years after that.

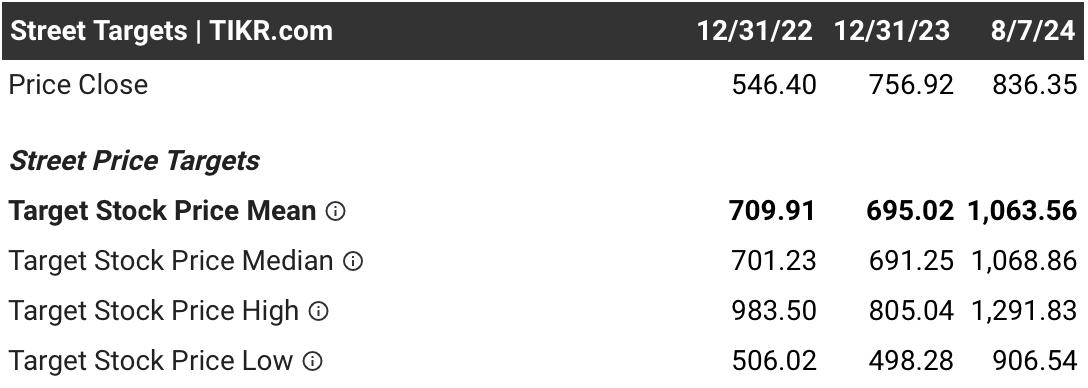

This doesn’t mean the short term also isn’t brighter. The management likes to be conservative in its estimates. And despite a somewhat pessimistic outlook (perhaps representative of European mentality?) for 2024 by the management, ASML has a proven track record of beating expectations. And Wall Street analysts expect a pick-up in earnings in the last two quarters of the year, in particular the last quarter (28.69% earnings growth year-over-year).

That could well trigger a wonderful rally going into the end of the year, combined with interest rate cuts by most major banks in the world to boost the economies again.

Valuation

From a valuation perspective, the recent drop powered by fears of macroeconomic slowdown was quite healthy for the company. It looks like it returned to its fair value.

It is trading right at the historical median of 30x FWD earnings. Given the expected acceleration in earnings in the next years, and even if the valuation remains at 30x (without multiples expansion, which usually happens when interest rates come down), that could send the stock up by at least double digits every year. The stock price appreciation would at least reflect 1-to-1 the expected growth rates in both top and bottom lines in the next few years.

In our opinion, the Wall Street Target above $1,000 per share (minimum +20% upside) are far from exaggerated and quite reasonable, especially given we were at that level very recently.

Risk Factors That Could Impact Our Buy Case

As for every investment, there are real risks. There are general macroeconomic risks, such as the extension of what caused the business to have a flat growth this year: inflation, supply chain disruptions, economic uncertainty.

Additionally to those risks that essentially all companies face, there are company-specific risks. The main one is how strategic ASML is (geo)politically speaking. This provides privileges of course, but it’s also a real risk. Trade wars between the U.S. and China (and Taiwan through TSMC) for chips, could lead to increased pressures on the Dutch government to restrict the export of certain products by ASML.

The U.S. and China are both very large and strategic trade partners for the Netherlands and ASML could well be stuck between both chairs. For now the risks looks somewhat mild, but a Trump election could reactivate the risk given his hard stance against China. But even then, it’s extremely unlikely that the Netherlands will throw ASML under the bus. It’s a strategic company of national interest that can count with the political national support.

Bottom Line

Timothy (Panic Drop) and I, we both have the stock in our publicly copiable portfolios on eToro. So the buy case here is really no secret. We actually both liked the recent stock price drop of this fantastic business because it resets it for a healthier rally in the next few quarters and years as ASML’s order flow and financial growth re-accelerate.

There are real risks from the macroeconomic level to company-specific risks, but all these are sufficiently mitigated at the moment and the fundamentals remain unaltered.

Indeed at the end of the day, it’s a company with a unique moat, that is currently irreplaceable given the technology it masters. And that’s reason enough to hold the stock for the long-term. Warren Buffett said “it's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

We have in ASML a wonderful company at a pretty good price.

—

Make sure to subscribe to both newsletters and thank you for reading!

Etcaetera & Panic Drop

It was great working together with you on this analysis!

I live not far from the Netherlands. People say ASML pays large bonuses to its employees at year end.