Ryanair: the Only Airline Worth Investing In?

A Low Cost Airline but a High Value Stock

Ryanair Overview

Ryanair is one of the most iconic brands, beating by far any other airline. The Irish company, founded in 1984 by a group of Irish businessmen (including Tony Ryan), has managed to turn into an everyday conversation topic, both in real life and on social media. It branded itself as a cheap airline with a modern check-in process, and of course, its hyper-efficiency gives to its customers the image of a greedy corporation.

Still, its marketing is unbeatable and the company keeps gaining market shares versus competitors across Europe and North Africa.

I generally don’t like airlines because

they are capital intensive;

they have low margins;

they have very little innovative and technological breakthroughs;

and literally anything can affect their profitability: from fuel prices to weather patterns, from regulatory news to social troubles, from macroeconomic weakness to M&A activity in the sector - and the list goes on and on.

But Ryanair is different. And the recent performance, despite headwinds, shows resilience and opens up to optimistic perspectives.

Recent Performance - My Traffic Light Shows Resilience

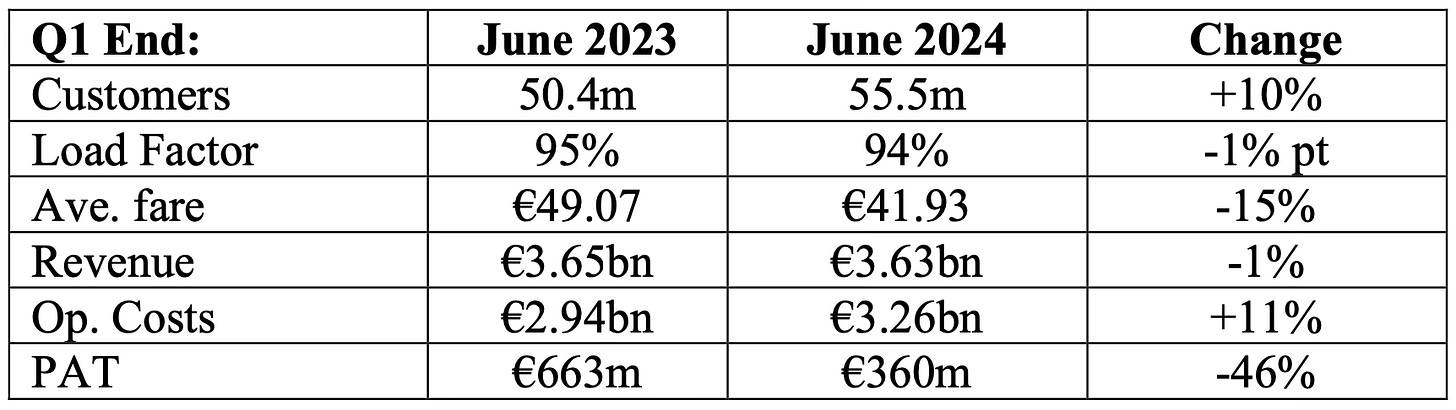

Key takeaways in terms of performance in Q2 this year:

🔴 Q2 profit of €360m, compared to a prior-year Q2 profit of €663m. Strong drop in profits due to Easter timing relative to previous year and weaker than expected air fares.

🔴 PAX revenue1 fell 10% (average fare down 15%).

🟠 Total revenue almost flat (-1%, from €3.65 bn to 3.63 bn)

🟢 Strong traffic growth (+10%) to 55.5m customers in the quarter

🟢 Record Summer schedule launched (5 new bases, over 200 new summer-24 routes)

It’s a mixed picture when it comes to the number in the last quarter. There is no secret there. But I believe the toughest is behind us from a macroeconomic and energy point of view. All airlines have struggled. And Ryanair in fact outperformed its competitors.

Competition and Market Shares

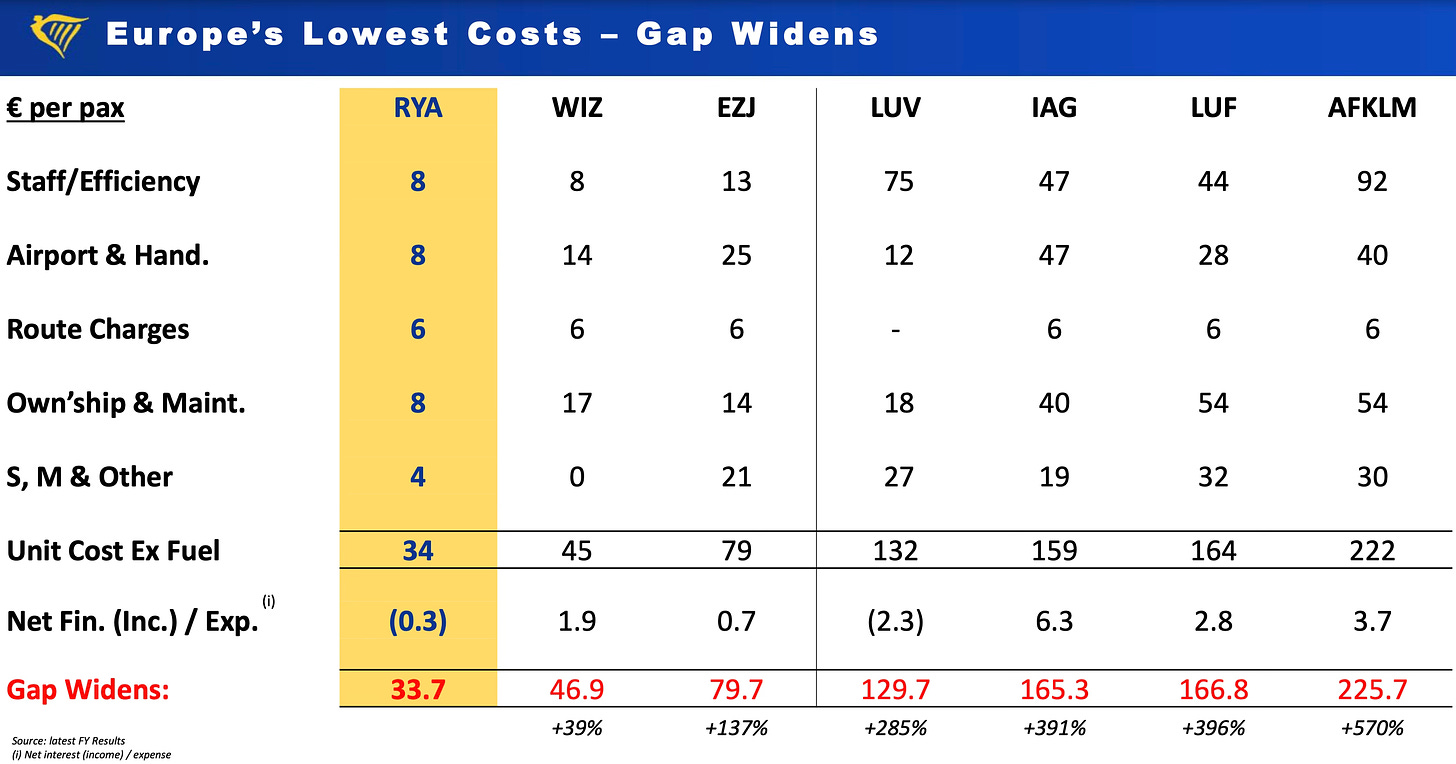

Ryanair is more efficient than its competitors by a mile. Excluding fuel, the PAX cost of Ryanair is €33.7. Let’s pause here. Thirty three point seven euros to fly a passenger!

Wizzair, another low cost, is 39% more expensive and EasyJet, also a low cost spends more than double of Ryanair to fly a passenger (on average). I am not even going to comment the efficiency of Southwest Airlines, IAG, Lufthansa and Air France-KLM relative to Ryanair...

Let me show you something else.

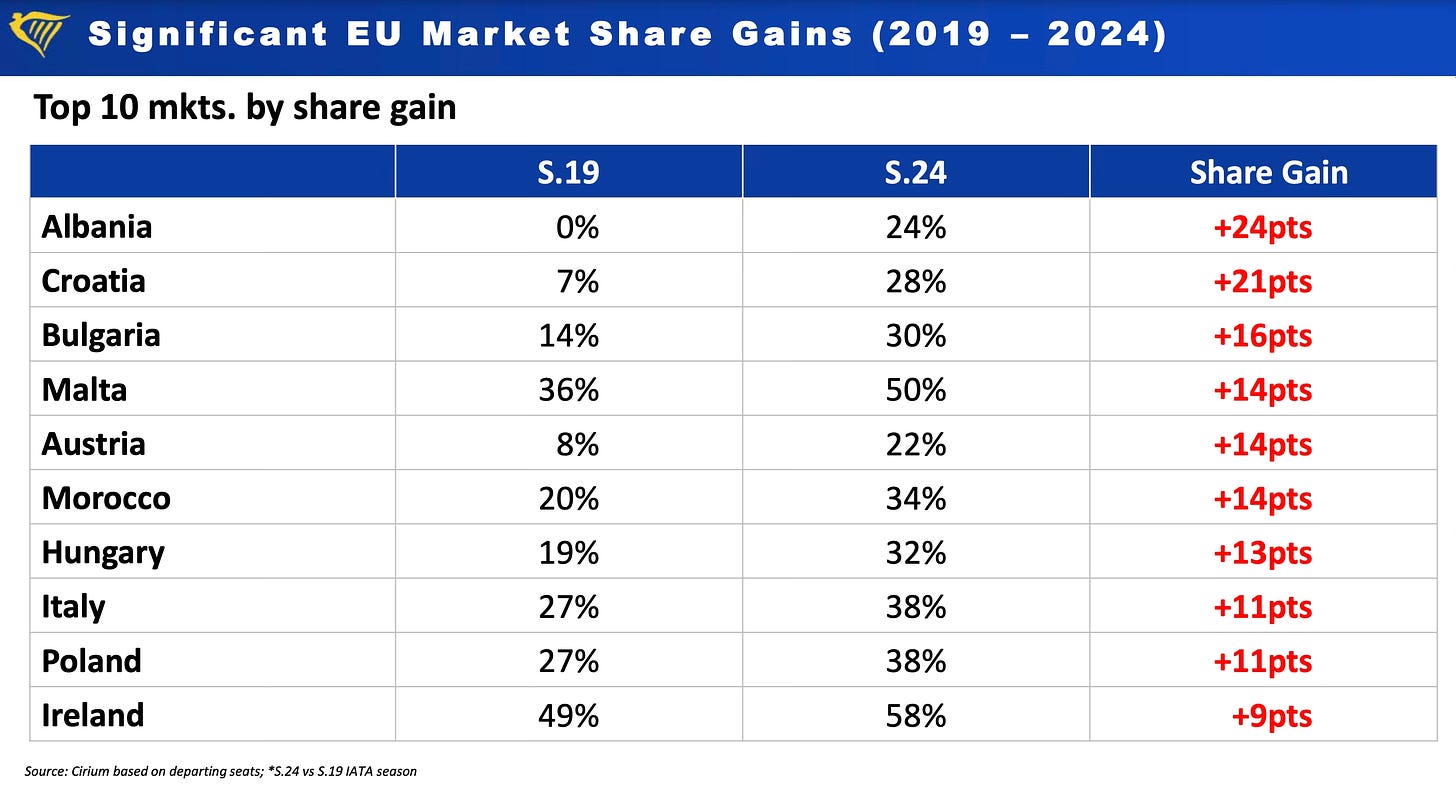

That is growth right there. When in doubt, zoom out. The quarter was OK but not wow, despite new routes opening and a 94% load factor.2

Ryanair is establishing itself as a reference where it had no presence (Albania) or very little presence (Croatia, Austria, both highly touristic destinations) just 5 years ago. It is also successfully expanding beyond Europe (Morocco). There is potential for more growth ahead.

From a Shareholder Perspective

From an investor point of view, the picture is much rosier and the stock is in a long-term uptrend despite recent sharp sell-off (from $60 per share to $40 per share on the ADR3 stock).

🟢 A little over 50% of the currently authorized €700m share buyback that started in May is completed. When complete, Ryanair will have returned over €7.8bn to shareholders since 2008. Its market cap is around €17-18 bn, meaning the company already returned almost half of today’s MC to the shareholders.

🟢 Ryanair’s balance sheet is one of the strongest in the industry with a BBB+ credit rating (both S&P and Fitch) and €4.49bn gross cash at quarter end, despite €0.50bn capex and €0.25bn share buybacks. Net cash increased to €1.74bn on by end of Q2, up from €1.37bn at the end of Q1. Ryanair’s B737 fleet (566 aircraft) is fully unencumbered, impacting positively the cost advantage over competitor airlines (exposed to expensive lease and financing costs).

🟢 Traffic this year is expected to grow 8% subject to no worsening of Boeing delivery delays.

Valuation

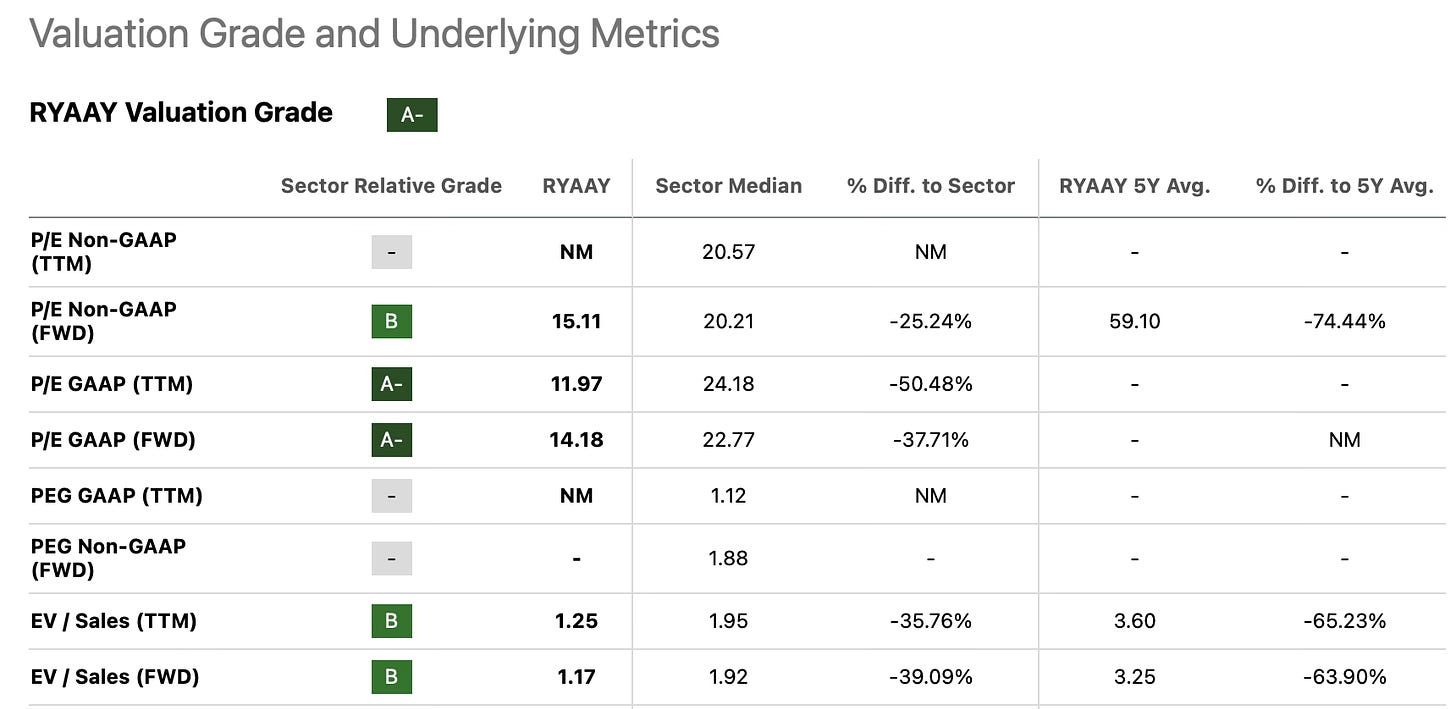

The stock is trading dirt cheap.

🟢 Ryanair is trading at 14x forward earnings and 12x trailing earnings, at a significant discount from the airline sector which is trading at 22x and 24x earnings respectively (37% and 50% discount).

🟢 Ryanair is trading at around 1.2x sales (both forward and trailing) at a 35-40% discount from the sector and, perhaps even more interestingly, at a 64-65% discount relative to its own 5-year average.

That’s a screaming buy and with a slowly improving outlook I am betting my Euros that the market will reprice the stock accordingly in the next quarters.

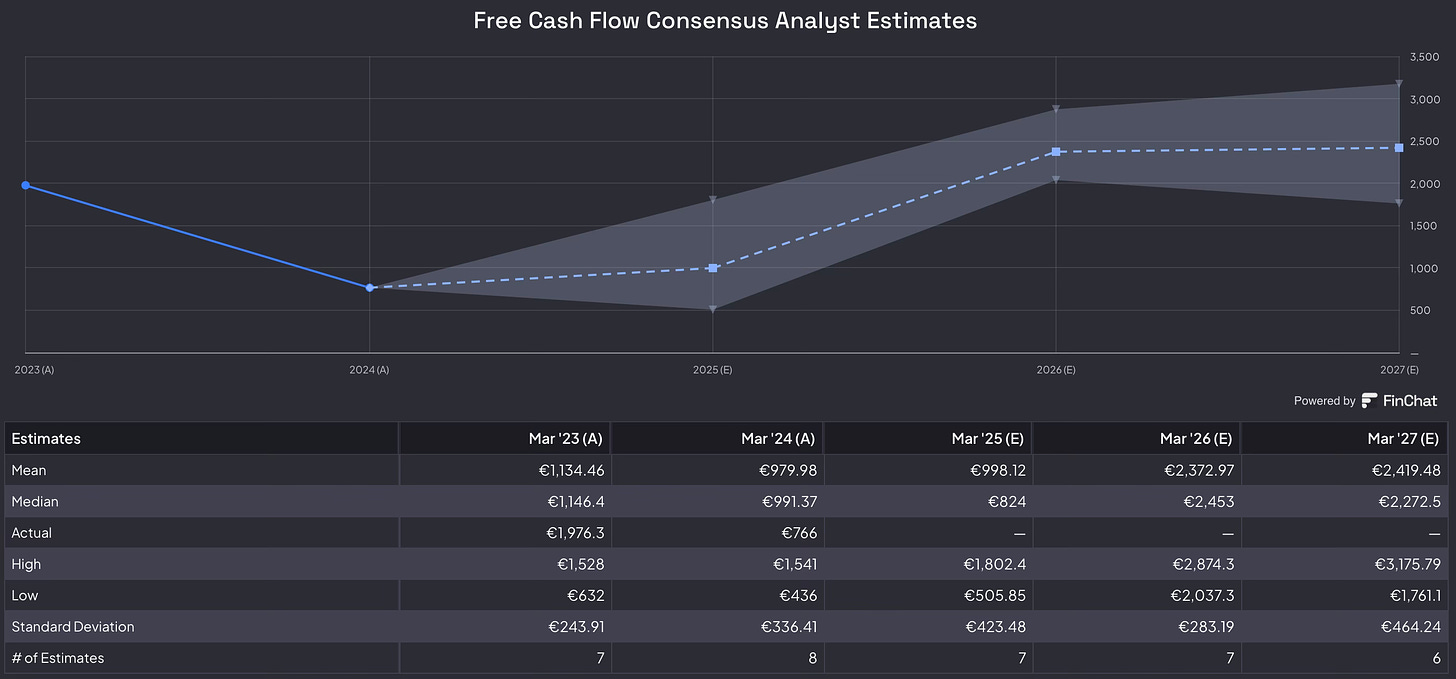

Analysts expect a huge ramp-up in free cash flow with a significant improvement by the first quarter of 2026. I want to be in the train (or plane) when that happens.

Risks

As for every investment, there are risks. And for Ryanair in the next 12 months, there is one big risk and a smaller one.

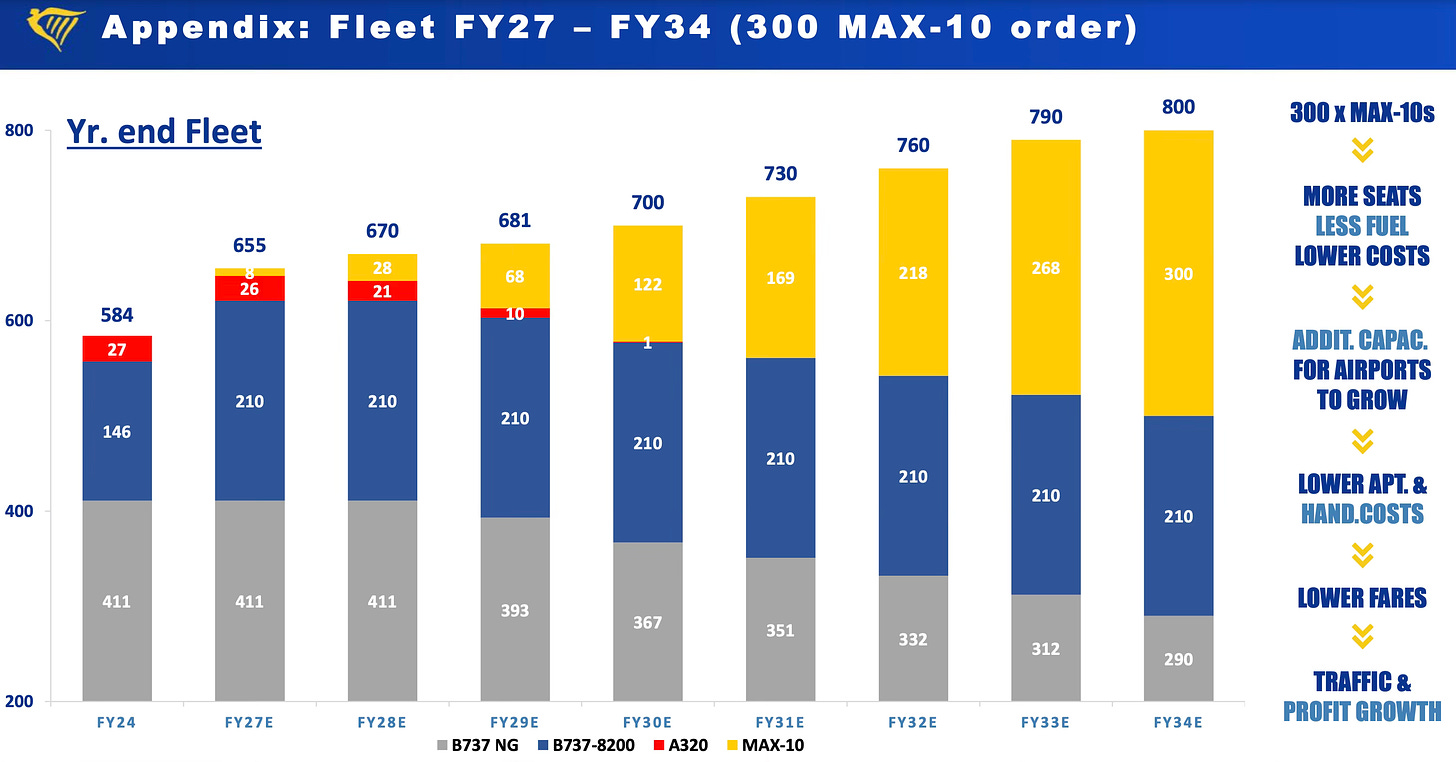

🔴 Boeing delays: really the key risk is here. I call it a big risk because there is really nothing Ryanair can do to mitigate it in the short term and Boeing has been having its share of problems. Ryanair’s entire fleet pipeline is dependent on Boeing until at least 2034.

Ryanair has modeled as part of its growth the acquisition of 300 Boeing MAX-10. They are much larger and more efficient in terms of fuel. There is no MAX-10 to date in Ryanair’s fleet. Boeing will have to give gas… The change in CEO at Boeing a few weeks ago could turn out to be a welcome tailwind for Ryanair. Kelly Ortberg replaced David Calhoun on August 8, 2024.

🟠 Fuel prices. The higher the price of fuel, the more expensive it is to fly a plane. That is why oftentimes the airline sector performs in a reverse manner to the price of oil. The good thing is that Ryanair has fuel price hedges in place and has extended them at an interesting price: 75% FY25 at under $80bbl saves over €450m and c.45% FY26 is hedged at $78bbl. This strong hedge position helps insulate the Group from significant fuel price volatility. The hedge proportion is declining from 75% to 45% but in my opinion it’s a smart strategy of management as oil has been less volatile than at the outbreak of the Ukraine-Russia war.

Bottom Line

I don’t like airlines. That’s not a secret. But Ryanair is something else. It has the alpha in the sector that I needed to see to add it to my portfolio. I bought a large position in Ryanair this week. The business is much more efficient than its competitors. Sure, there is the Boeing risk - but that risk weighs on the others too. The management team has over the year demonstrated being extremely shareholder-friendly.

The stock is trading at a dirt cheap valuation, following recent sector turbulence (pardon the pun…). But it showed resilience and the outlook is much rosier than the past quarters that are now in the rear mirror. It’s a company that is always looking to innovate and become more efficient in a stagnant sector. Using the below rating matrix, I rate it a “BUY”.

I hope you enjoyed the read. 💚🙏 It was a little longer than usual, so let me know if you liked it or prefer a shorter format.

Consider upgrading your subscription to “paid” to support my independent work.

Thank you so much!

Etcaetera

PAX = it’s a sector-specific jargon for “passenger”.

That’s how full the planes are on average.

American Depositary Receipts. This allows non-US stocks to have a listing in the US as well.