The Top 3 Asset Types That Will Benefit from Interest Rate Cuts

I am answering the biggest question of the moment.

Practically on a daily basis people ask me at work, at home, and even when I am strolling in my neighborhood: where should I invest ahead of interest rate cuts?

Although there is not one simple answer to this question, there are certain market segments and even certain specific stocks that are the most likely to benefit from central banks’ interest rate cuts.

There will surely be a lot of “what about this asset”, “what about this sector”. Let’s be clear: practically all assets and sectors benefit from interest rate cuts. So don’t worry if your favorite asset or sector is not in the list, doesn’t mean you are wrong. 😉

First let’s see how markets are correlated to interest rates before moving to the potential outperformers.

How do interest rates impact the stock market?

Lower interest rates purely and simply means more debt for cheaper.

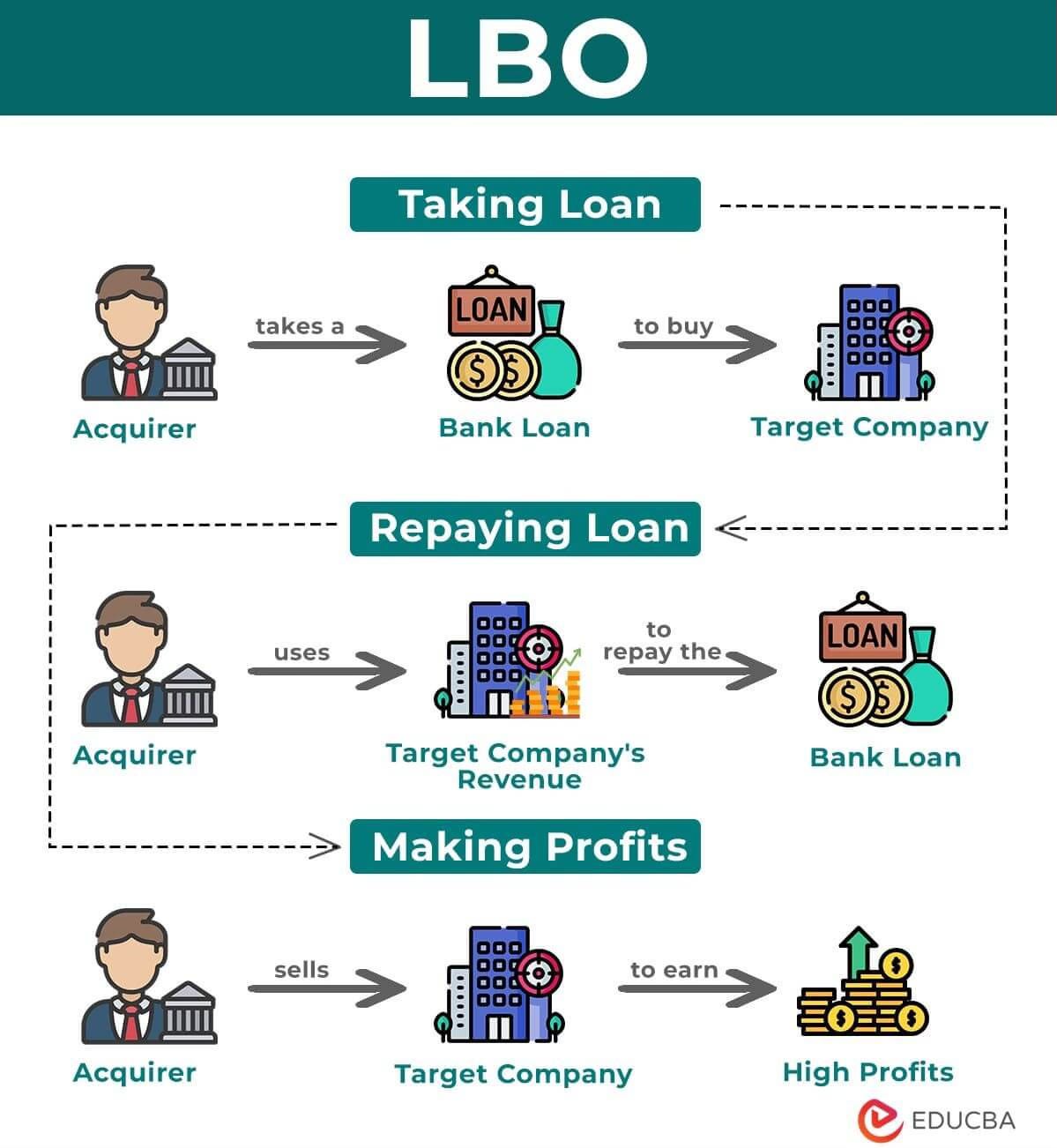

More debt for cheaper is music for LBOs1. More debt available for LBOs significantly increase the LBO volumes, and the pool of buyers. Given demand starts to outstrip supply, the prices of the targets (known as valuations) overall start to inflate. Interest rates act like a reverse magnet on stock valuations. Put simply: stock prices overall tend to rise when interest rates fall. That is why most assets benefit from lower rates.

But there is more.

People, just like you and I, have more money on the side as they can borrow more and for cheaper to buy or build a property, to purchase a new car or to finance big life projects that have been put on hold in times of high inflation and high interest rates.

Cheaper debt usually supports macroeconomic growth and hence growth of companies. Companies can finance and refinance themselves, especially smaller companies with limited resources but also the company that have been struggling because of too high interest rate payments.

Also governments spend less in interest rate payments and have more money available to spend on the development of the countries they govern.

This is what it implies for the stock market (and that could make you wealthier).

Keep reading with a 7-day free trial

Subscribe to Etcaetera - Easy Investing With a Portfolio Manager to keep reading this post and get 7 days of free access to the full post archives.